Starting April 1, 2023 as per the new tax policy passed by the government, 30% tax will apply on Net Winnings*.

What is Net Winnings

Net Winnings is the difference between the total withdraw amount and the total deposit amount in a financial year.

Total Withdrawals - Total Deposits = Net Winnings

When is Tax Deducted

Tax will be deducted at the time of a withdrawal or on 31st March 2024 (i.e. at the end of the financial year).

Tax Calculation with Examples

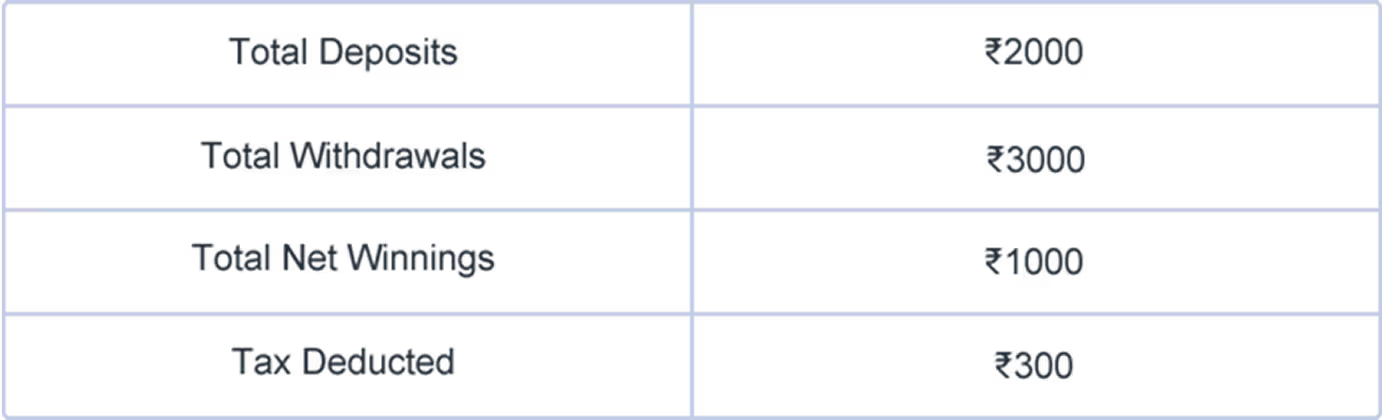

Example 1 - Positive Net Winnings, Tax Deducted

Note: 30% tax will be deducted on Net Winnings*

- Total Withdrawals - Total Deposits = Total Net Winnings

- Total Net Winnings: ₹3000 - ₹2000 = ₹1000

- Tax Deduction: ₹1000 * 30% = ₹300

- If you withdraw the total ₹3000, your withdrawal amount post tax deduction will be ₹3000 - ₹300 = ₹2700

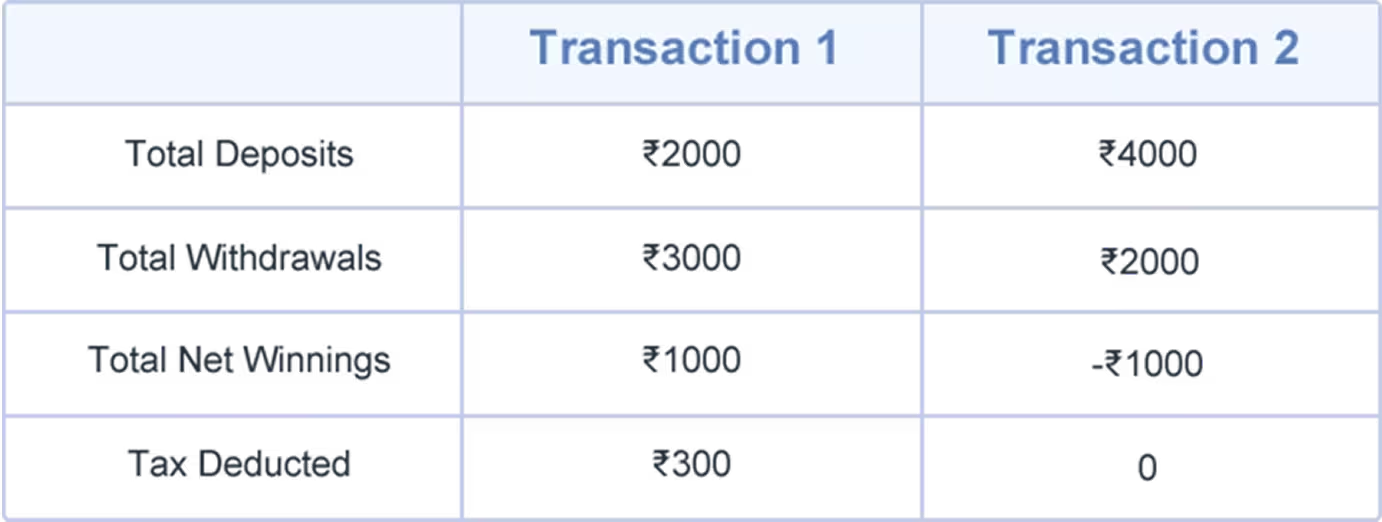

Example 2 - Negative Net Winnings, No Tax Deducted

Note: 30% tax will be deducted on Net Winnings.

When you make a withdrawal request, all deposits & withdrawals made by you until that time is considered to calculate Total Net Winnings.

- Total Withdrawals - Total Deposits = Total Net Winnings

- Total withdrawals: ₹3000 + ₹2000 = ₹5000

- Total Deposits: ₹2000 + ₹4000 = ₹6000

- Total Net Winnings: ₹5000 - ₹6000 = - ₹1000

As Net Winnings is negative, there will be no tax deduction.

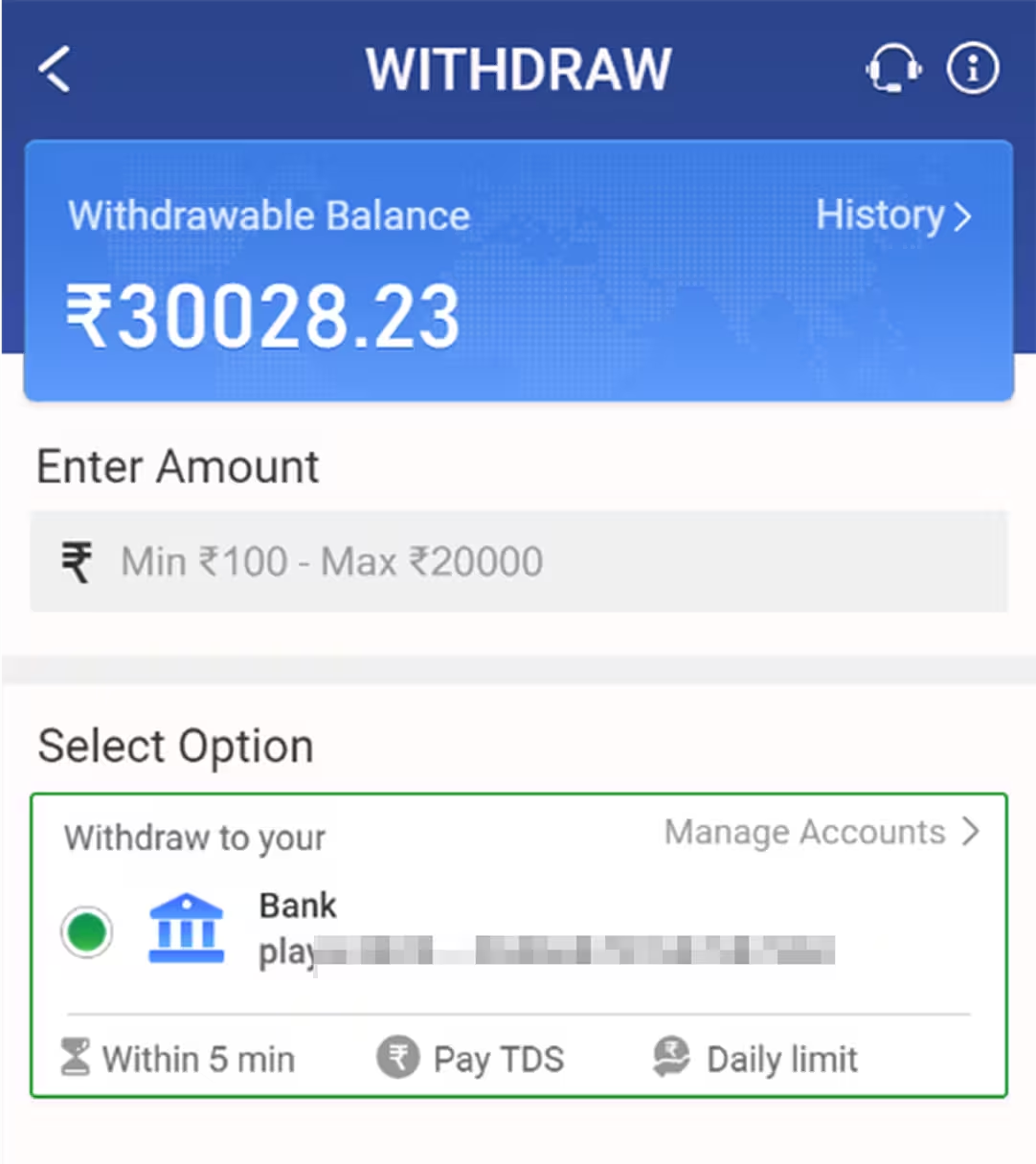

Tax Amount on Withdraw Page

- If tax is deducted on positive Net Winnings on withdrawals, tax will not be deducted again on the same Net Winnings on 31st March 2024 (at the end of the financial year).

- If Net Winnings are negative on 31st March 2024 (at the end of the financial year), players may be eligible for a tax refund and can claim the same while filing Tax Return.

Financial Year-End Settlement

At the end of each financial year (i.e. 31st March), if there is a balance in the player's account (deposit balance + withdrawable balance), TDS (Tax Deducted at Source) will be deducted from that amount by considering the whole amount as a withdrawal for that financial year.

TDS Liability

TDS liability will not be carried forward to the next financial year. The closing balance after TDS deduction will become the opening balance for the next financial year.

Calculation of Total Withdrawal

Total Withdrawal = Withdrawals made in the FY + Account balance on 31st March.

Calculation of Net Winnings

Net Winnings = Total Withdrawal − Total Deposit − FY Opening Balance

Note: Net winnings from which TDS has already been deducted will not be considered for year-end settlement.

Let’s understand this through a few examples:

Example 1 - No Withdrawals During the Financial Year

Opening Balance (1st April 2023): ₹3,000

Closing Balance (31st March 2024): ₹10,000

Withdrawals in FY: ₹0

Total Deposit: ₹3,000

Calculation:

Total Withdrawal (Total account balance is treated as withdrawal) = ₹13,000

Net Winnings = ₹13,000 − ₹3,000 (Total Deposit) − ₹3,000 (Opening Balance) = ₹7,000

TDS Deduction (30%) = ₹2,100

Result:

₹2,100 will be deducted from the account balance on 31st March 2024.

₹7,900 will be carried forward as the opening balance for the next financial year.

Example 2 - Multiple Withdrawals and Deposits During the Financial Year

Opening Balance (1st April 2023): ₹3,000

Closing Balance (31st March 2024): ₹5,000

Withdrawals in FY: ₹30,000

TDS Already Paid During FY: ₹4,000

Total Deposit: ₹10,000

Calculation:

Total Withdrawal (Withdrawals in FY + Closing Balance) = ₹30,000 + ₹5,000 = ₹35,000

Net Winnings = ₹35,000 − ₹10,000 (Total Deposit) − ₹3,000 (Opening Balance) = ₹22,000

TDS Deduction (30%) = ₹6,600

Final TDS Due = ₹6,600 − ₹4,000 (TDS Already Paid) = ₹2,600

Result:

₹2,600 will be deducted from the player’s account on 31st March 2024.

₹2,400 will be carried forward as the opening balance for the next financial year.

Example 3 - Net Winnings on 31st March are 0

Opening Balance (1st April 2023): ₹5,000

Closing Balance (31st March 2024): ₹5,000

Withdrawals in FY: ₹15,000

TDS Already Paid During FY: ₹1,500

Total Deposit: ₹10,000

Calculation:

Total Withdrawal (Withdrawals + Closing balance) = ₹15,000 + ₹5,000 = ₹20,000

Net Winnings = ₹20,000 − ₹10,000 (Total Deposit) − ₹5,000 (Opening Balance) = ₹5,000

TDS Deduction (30%) = ₹1,500

Final TDS Due = ₹1,500 − ₹1,500 (TDS Already Paid) = ₹0

Result:

No TDS will be deducted on 31st March 2024.

₹5,000 will be carried forward as the opening balance for the next financial year.

Example 4 - Net Winnings on 31st March are Negative

Opening Balance (1st April 2023): ₹8,000

Closing Balance (31st March 2024): ₹2,000

Withdrawals in FY: ₹16,000

TDS Already Paid During FY: ₹2,800

Total Deposit: ₹12,000

Calculation:

Total Withdrawal (Withdrawals + Closing balance) == ₹16,000 + ₹2,000 = ₹18,000

Net Winnings = ₹18,000 − ₹12,000 (Total Deposit) − ₹8,000 (Opening Balance) = -₹2,000

TDS Deduction (30%) = ₹0

Result:

No TDS will be deducted on 31st March 2024.

₹2,000 will be carried forward as the opening balance for the next financial year.

Excess TDS Paid: ₹2,800

In this case, the player will have to claim a TDS refund from the Income Tax Department when they file their ITR.

FAQs

1. What exactly are the New Tax Policy?

As per the Finance Act 2023, all reward Gaming Apps are mandated to deduct tax at the rate of 30% on player's Net Winnings at the time of withdrawal or on 31st March (at the end of Financial Year).

2. How is tax calculated on 'Net Winnings'?

Net Winnings is the difference between the total withdraw amount and the total deposit amount in a financial year. Tax is calculated at the rate of 30% of Total Net Winnings at the time of Withdrawal.

3. I see different amounts getting deducted each time. What is the logic for TDS calculation?

The TDS is deducted based on 3 parameters - Net Winnings, TDS already paid, and withdrawal amount. 30% TDS is deducted from Net Winnings subject to a maximum of 30% of the withdrawal amount. TDS Deducted will be calculated on your Net Winnings at the time of withdrawal and the calculation will be detailed out in the Tax Sheet.

4. When will tax be deducted?

Tax will be deducted on Net Winnings at the time of withdrawal or on 31st March (at the end of the Financial Year). If tax is deducted on positive Net Winnings on withdrawals, tax will not be deducted again on the same Net Winnings on 31st March.

5. Will tax be deducted if I withdraw an amount lesser than my total deposits?

If your total withdrawal is less than your deposit, no tax will be deducted.

For example,

Net Winnings = Total Withdrawals - Total Deposits

If Total Withdrawals = ₹2000, Total Deposits = ₹4000

Then Net Winnings = ₹2000 - ₹4000 = - ₹2000

As Net Winnings is negative, there will be no tax deduction.

6. I have already completed KYC verification, why is PAN needed?

PAN is needed to issue a TDS certificate, which can be used for filing ITR and claiming a refund (if any). You will be unable to withdraw reward if your PAN is not linked to your Yes Rummy account.

7. If my 'Net Winnings' is negative during the year, can I get a refund of tax already deducted?

Tax on Net Winnings at the time of the withdrawal that are deducted are paid to the income tax department for the credit of the player. Players can file their returns with the income tax department and claim refunds subject to the player's overall tax liability. GCC INNOVATIONS PRIVATE LIMITED will be issuing the tax deduction certificates showing the tax deducted for the player. However, GCC INNOVATIONS PRIVATE LIMITED will not be able to refund the excess tax from our end directly to any player.

8. How can I get my Tax Certificate to file IT Returns?

Tax Certificates will be issued from GCC INNOVATIONS PRIVATE LIMITED within 90 days from the last date of filing TDS returns for every quarter.

9. Will my Opening Account Balance be considered if I want to make a withdrawal at the start of the new Financial Year (April 2024)?

At the start of the new Financial Year (1st April 2024), if there's an Opening Balance, Net Winnings will be (Total Withdrawals) - (Total Deposits) - (Opening Balance). If Net Winnings is negative, there will be no tax deduction.